The meat industry is in a difficult environment

The German meat industry is in a difficult environment. Pig stocks are also declining significantly due to the federal government's current agricultural policy. Other reasons are weak demand due to inflation and the export ban on wild boar in Germany due to African swine fever. Cattle stocks are also declining. For the slaughterhouses, this means fewer animals for slaughter and necessary adjustments. At the same time, the increasing economic burdens caused by the energy crisis and high prices and wages are increasing at all stages of the marketing chain.

Apart from the current reluctance to buy, the consumption of meat has been declining since 2012 and is 51,7 kg/capita in the current year. While the consumption of beef and poultry is largely stable, the consumption of pork has fallen by around ten kilograms since 2012 to an estimated 28,5 kg per capita. The consumption of sausage and ham is around 26 kg/head.

Slaughterhouses and processing companies are concerned about the possible consequences of the various national legal regulations that are currently being discussed in Germany. The planned national solo efforts in the legislation of the traffic light coalition make access to the European market, which is of great importance for companies and employees in the industry, more difficult.

The offer

In 2022, meat production in Germany fell by 2021 t compared to 645 to 7,557 million t slaughter weight. This means that meat production has declined for the sixth year in a row and, at 7,9%, has never been so strong since the unification-related reduction in stocks in the 1990s. The decline mainly affected pork and beef.

The commercial slaughter of Pigs continued in 2022 compared to the previous year and this time fell extremely sharply by 9,2% (- 4,773 million animals) to 47,102 million animals. The decline came almost exclusively from the lower number of domestic animals (- 4,848 million to 50,718 million animals). In contrast to the previous year, the number of foreign pigs slaughtered increased by 6,5% to a good 1,2 million animals. Compared to 2021, pork production decreased by 9,8% (485.000 t SG) to 4,481 million t. The downward movement continued unchanged at the beginning of 2023.

The number of commercial slaughtered Cattle decreased in 2022 compared to the previous year by 7,8% to 3,0 million animals, which together brought a slaughter weight of 0,98 million t. The decline affected all categories except for the oxen, which are not very relevant in terms of numbers. The slaughter of cows and heifers fell particularly sharply by 10,1 and 9,1% (minus 112.600 and 52.000 head respectively) to 1,006 million and 0,520 million animals respectively. The bulls fell by 79.000 to just 1,117 million animals. The amount of beef produced fell by 2021% compared to 9,1 to 476.100 t (- 47.500 t).

There was also a significant decline in the sheep sector. The slaughter figure was 1,119 million head, 8,0% less than 2021, with a slaughter weight of 22.946 t.

German sausage and ham production is increasing

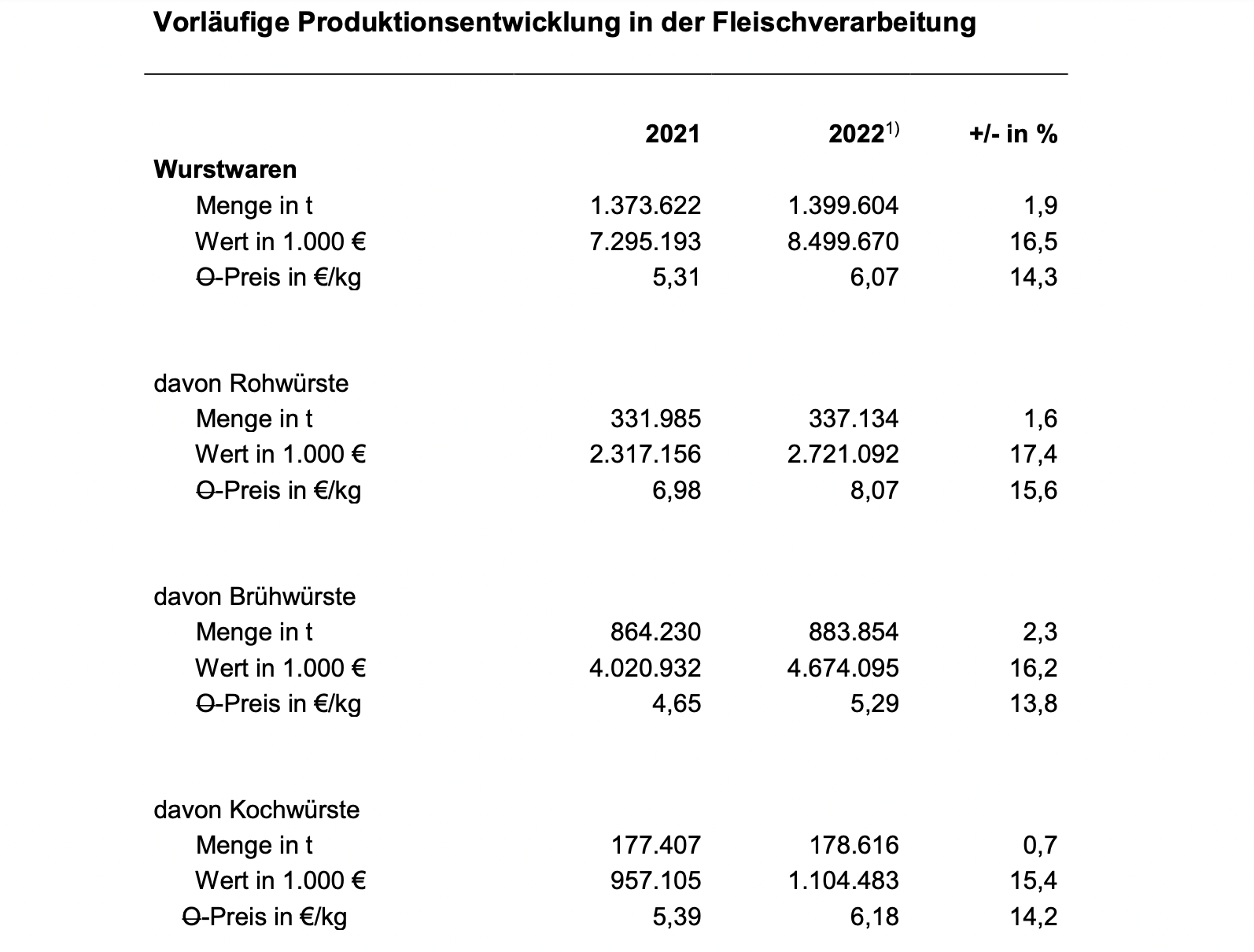

After the difficult years of the pandemic and the associated drop in demand in the catering trade, German sausage and ham producers were able to increase their production again slightly last year by 1,9 percent compared to the previous year. However, the production volume of the pre-Corona period has not yet been reached. A total of 2022 million tons of sausages (without ham) were produced in 1,399.

Due to inflation, the industrial sales prices rose by 14,3 percent, so that sales also increased significantly by 7,295 percent from EUR 8,499 billion to EUR 16,5 billion.

With an increase of 2,3 percent from 864.230 tons to 883.854 tons, boiled sausages, the largest product area, have grown the most. The production volume for raw sausages increased by 1,6 percent from 331.985 tons to 337.134 tons. Boiled sausages increased by 0,7 percent from 177.407 tons to 178.616 tons.

At present, demand continues to be subdued by the inflation-related high cost pressure on private households. Due to the usually higher price level, meat substitutes and organic products have to struggle with particularly difficult market conditions and remain market niches.

Demand for meat shaped by the waning of the pandemic, social change, the Ukraine war and inflation

The Covid-19 pandemic and the associated restrictions in the catering trade as well as the increased focus on catering at home shaped the development of demand in 2020 and 2021. With the gradual opening up of public life, consumption habits normalized in 2022 and it became normal again increasingly eaten out, which means that purchases of meat and meat products by private households fell compared to the previous year. Added to this are the effects of massive negative reporting on the alleged harmful effects of meat production on the environment, especially on greenhouse gas emissions.

According to the market research institute GfK, the sales volume of meat in the retail sector fell by 8,7%. However, overall food expenditure increased by 8,3% due to the sharp rise in prices. In the second half of the year, gastronomy sales fell again by around 20% (in terms of sales) compared to the first half of the year.

The sharp increase in prices for all basic necessities, mainly caused by the consequences of the Ukraine war, had and continues to have a strong dampening effect on the demand for meat.

Although sales of meat substitutes are increasing, the proportion remains very low at 2,5% in relation to the quantities of meat, sausage and poultry demanded. As reported by the Agrarmarkt-Informationsgesellschaft (AMI), the volume turnover in this division increased by 2021% in 34. In 2020, growth was still 60%. For 2022, the AMI reports a further declining increase of 9,6%.

Overall meat consumption in Germany in 2022 fell by 4,2 kg to 52 kg per capita compared to the previous year, which is reflected in a downward trend for all types of meat. With a statistical per capita consumption of 29,0 kg, pork is still clearly at the top of German consumers' favourites, despite a decline of 2,8 kg. Poultry meat ranks second (12,7 kg; -0,4 kg), followed by beef (8,7 kg; -0,9 kg). The consumption of sheep and goat meat remained relatively stable at 0,6 kg and another 1,0 kg of other types of meat (particularly offal, game, rabbit).

Third country exports declining

German foreign trade in meat and meat products was also severely restricted in 2022 due to the further spread of African swine fever (ASF), and many third countries maintained import bans on German pork.

With a good 3,4 million tonnes of meat and meat products exported, the German meat industry recorded a decline in volume of 2022 tonnes (- 224.000%) in 6,2. However, export earnings rose by 16,7% to almost €10 billion due to strong price increases.

Exports of German sausage products decreased to 2022 t in 152.586 (previous year: 154.439). The export of meat products totaled 514.825 t, 1.300 t more than the year before.

The most important buyer countries for meat and meat products from Germany are the EU countries, to which 80 to 90% of the export quantities flow, depending on the animal species and product category. Since the outbreak of ASF, the export of pork to third countries has remained very limited.

Fresh and frozen pork accounted for at least three quarters of all meat exports in 2022, with the export volume falling by 12,4% to a total of 1,46 million tonnes. Third-country exports fell by around a third year-on-year after falling by half in the previous year. The export of by-products also fell in 2022, with a total decrease of 11% (third countries - 31%). The main reason for this is primarily the ASP-related loss of many important sales markets in Asia, especially China.

In domestic trade, too, German pork exports recorded a decline of 2021% to 7,3 million t compared to 1,242, albeit less. The share of third countries in total German pork exports fell from a good 19% in 2021 to just 14% in 2022.

Fresh and frozen beef exports remained roughly flat in 2022 compared to the previous year, having previously increased by around 6%. The export quantity was around 252.000 t. Due to the sharp rise in prices in the beef sector, the export value increased by 26% to €1,5 billion.

The sharp decline in exports to third countries by 13% contrasted with a slight increase in domestic trade. As a result, the share of sales in domestic trade increased by two percentage points to a good 90%. Target countries outside the EU were above all Norway, Switzerland, the United Kingdom and Bosnia and Herzegovina. Exports to Norway fell by around 44% compared to the previous year to just 7.400 t due to the suspension of tariff reductions, which the Norwegian government takes depending on the market situation. Deliveries to Switzerland fell by 4% to 7.300 t. Deliveries to the UK increased by 60% to around 5.000 t.

The future development of German export performance, due to the great importance of the pork sector, depends on the success of the containment measures and, above all, the ASP regionalization negotiations, which the Federal Ministry of Food and Agriculture (BMEL) would have to vigorously conduct with third countries. The association promotes the opening and continuation of talks with the responsible authorities and delegations of third countries in order to achieve further market openings. Export markets remain of existential importance for securing sales in the German meat industry, since value can only be added for essential cuts of meat in third countries.

For many years now, a large part of the success achieved in expanding existing relationships and winning new markets can be attributed to working in cooperation with German Meat. After the Covid-19 pandemic, this export promotion has only been available again to the usual extent since the second half of 2022.

Imports also recorded a decline

In 2022, the volume of meat and meat by-products imported fell by 110.200 t or 5,1% year-on-year to a total volume of 2,03 million t. In contrast, meat imports continued to recover in 2022 from the sharp decline in 2020 and rose again compared to 2021 by around 5% or 17.200 t to around 369.000 t, including 117.991 sausages (plus almost 8.000 t).

On fresh and frozen Beef accounted for around 2022% of the total import volume of meat and by-products in 16. A good 87% of the beef was supplied from other EU countries. A total of around 317.200 t of beef were imported, a good 7% or 23.000 t less than in 2021. After the catering closures were lifted, imports from third countries increased again, but only moderately by 2022% to 8,1 t in 41.154. However, the significant decline in 2020 and 2021 could not be compensated for. In 2019, 56.700 tons of fresh and frozen beef were imported from third countries. The price situation in the meat sector in general, but also the sharp rise in prices in the catering industry in particular, certainly plays an important role in consumer behavior. Chilled beef accounted for 95,5% of beef imports.

Almost two thirds of the Germans Third country imports were shipped from Argentina (63%). Deliveries from Brazil followed in second place with a share of 10,7%. Uruguay is in third place with a 9,2% share in volume. UK shipments have picked up again. At 1.556 t, this is 3,8% of third country imports ahead of the USA with 3,1%.

The Germans pork imports decreased by 2022% to 6,6 t (fresh, chilled and frozen) in 689.765. A good 97% of all deliveries of fresh and frozen pork come from other EU member states. Because of Brexit, the level of imports from third countries increased slightly compared to the pre-Brexit period, but remained negligible at 17.000 t or 2,4% of total imports in 2022. In addition to the UK, Chile, Norway, the USA and Switzerland are potential suppliers of pork to the EU. The majority of VK deliveries are halves of sows, which are not sufficiently sold there.